Self assessment tax return 2023-24 are now due

- Aamer Amin

- Jan 9, 2025

- 2 min read

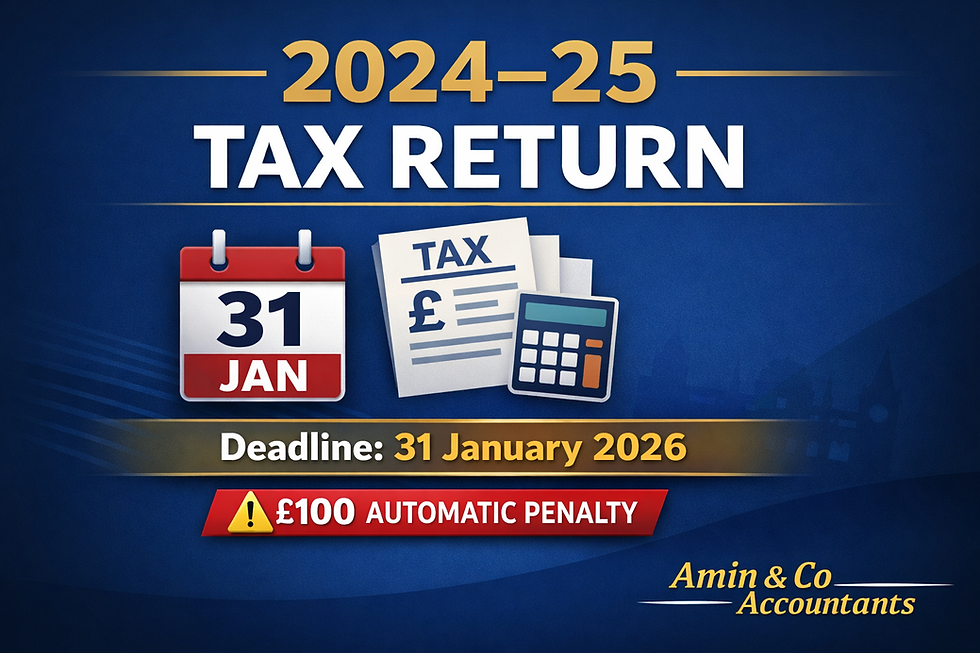

Self-Assessment tax returns for 2023-24 are now due to file

Self-Assessment Deadlines by 31 January 2025

Deadline for telling HMRC you need to complete a return

You must tell HMRC by 5 October if you need to complete a tax return and have not sent one before.

Deadline for submitting a paper return

If you’re doing a paper tax return, you must submit it by midnight 31 October 2024.

Deadline for submitting an online return

If you’re doing an online tax return, you must submit it by midnight 31 January 2025.

Deadlines for paying tax you owe

You need to pay the tax you owe by midnight 31 January 2025.

There’s usually a second payment deadline of 31 July if you make advance payments towards your bill (known as ‘payments on account’).

You’ll usually pay a penalty if you’re late. You can appeal against a penalty if you have a reasonable excuse.

When the deadline is different

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension, if you owe less than £3000.

HMRC must receive a paper tax return by 31 January if you’re a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

HMRC might also email or write to you giving you a different deadline.

Partnership returns if you have a company as a partner

If your partnership’s accounting date is between 1 February and 5 April and one of your partners is a limited company, the deadline for:

online returns are 12 months from the accounting date

paper returns are 9 months from the accounting date

Comments